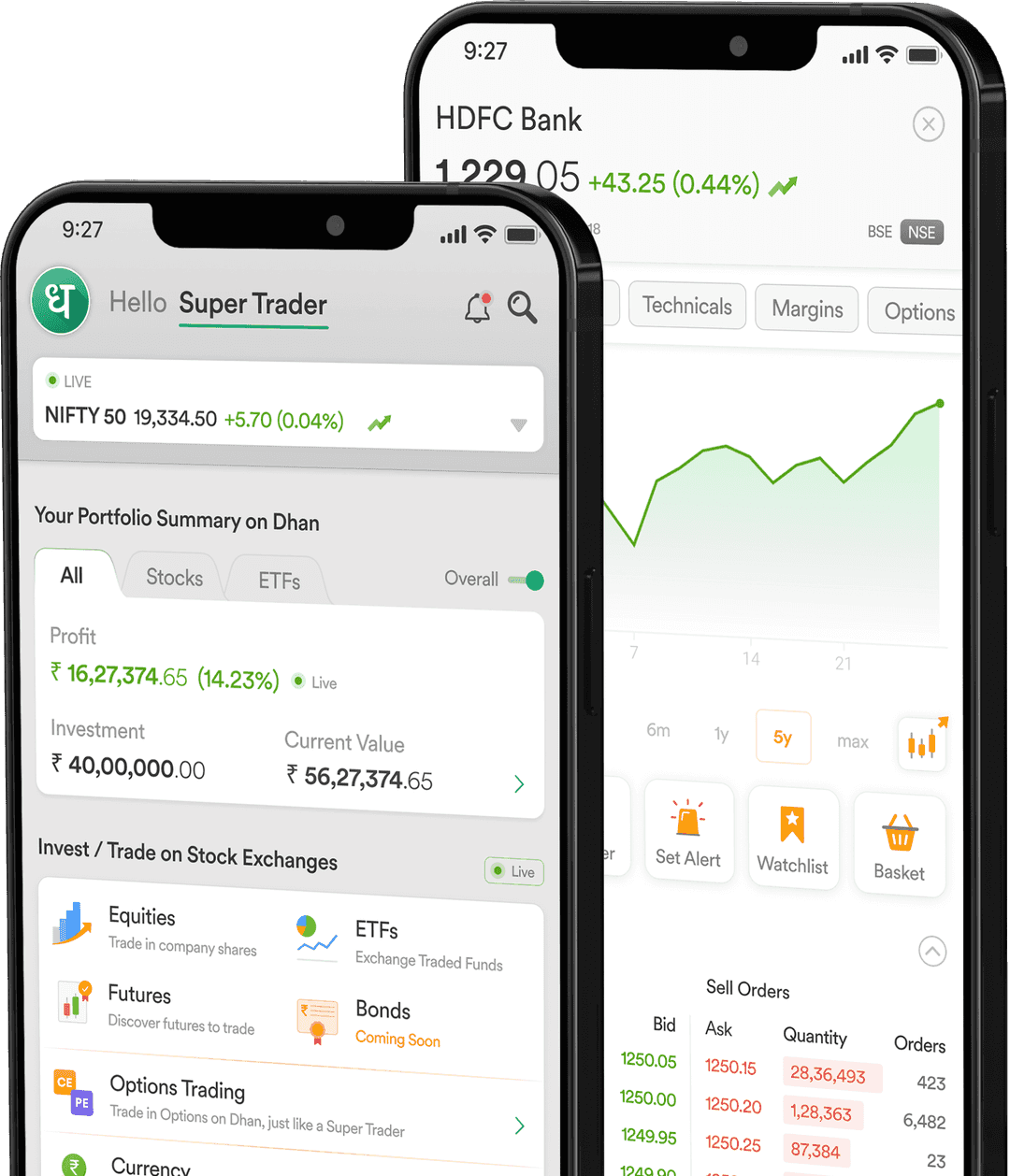

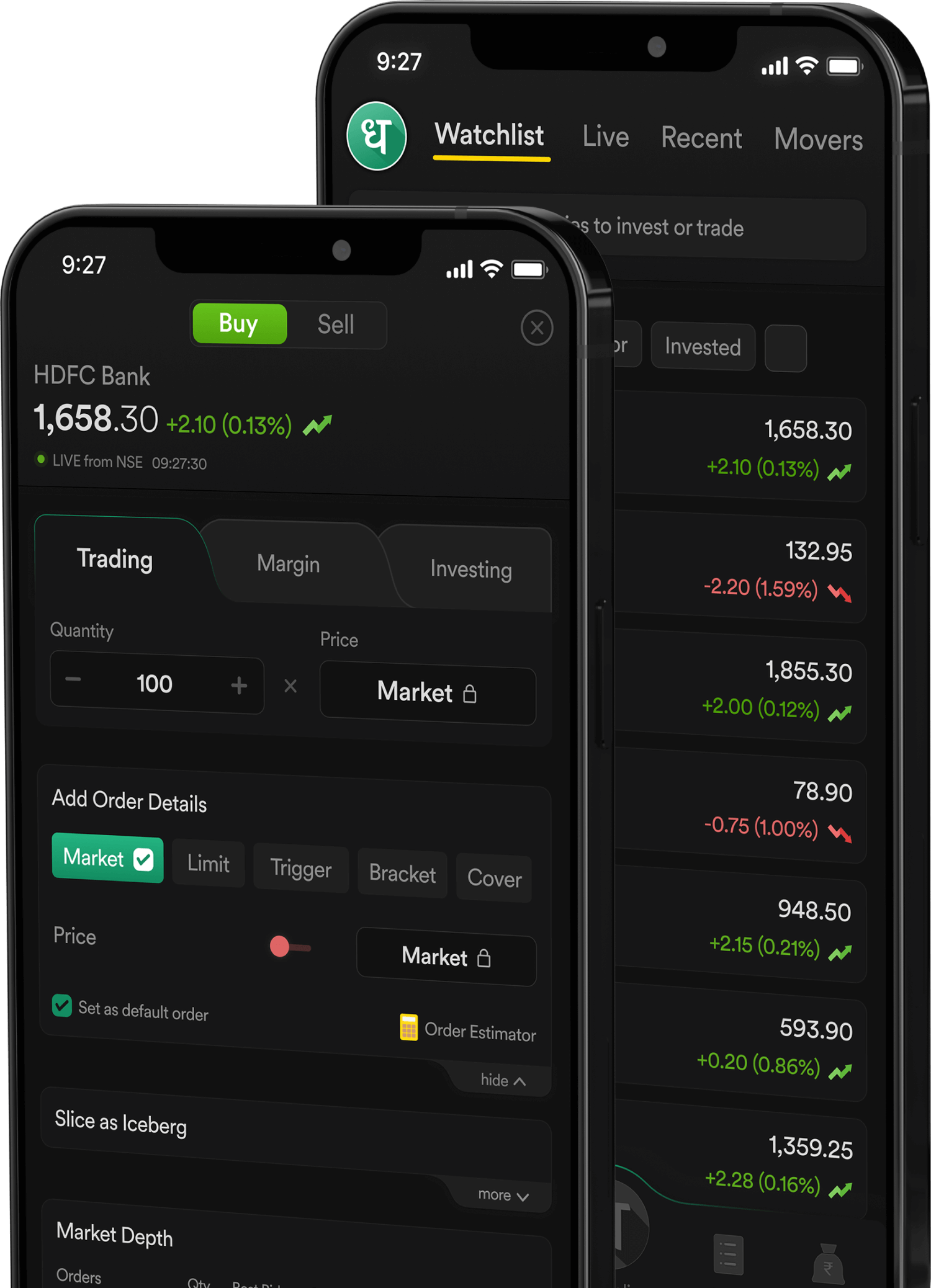

Dhan App

Stock Market App built for Super Traders & Long Term Investors.

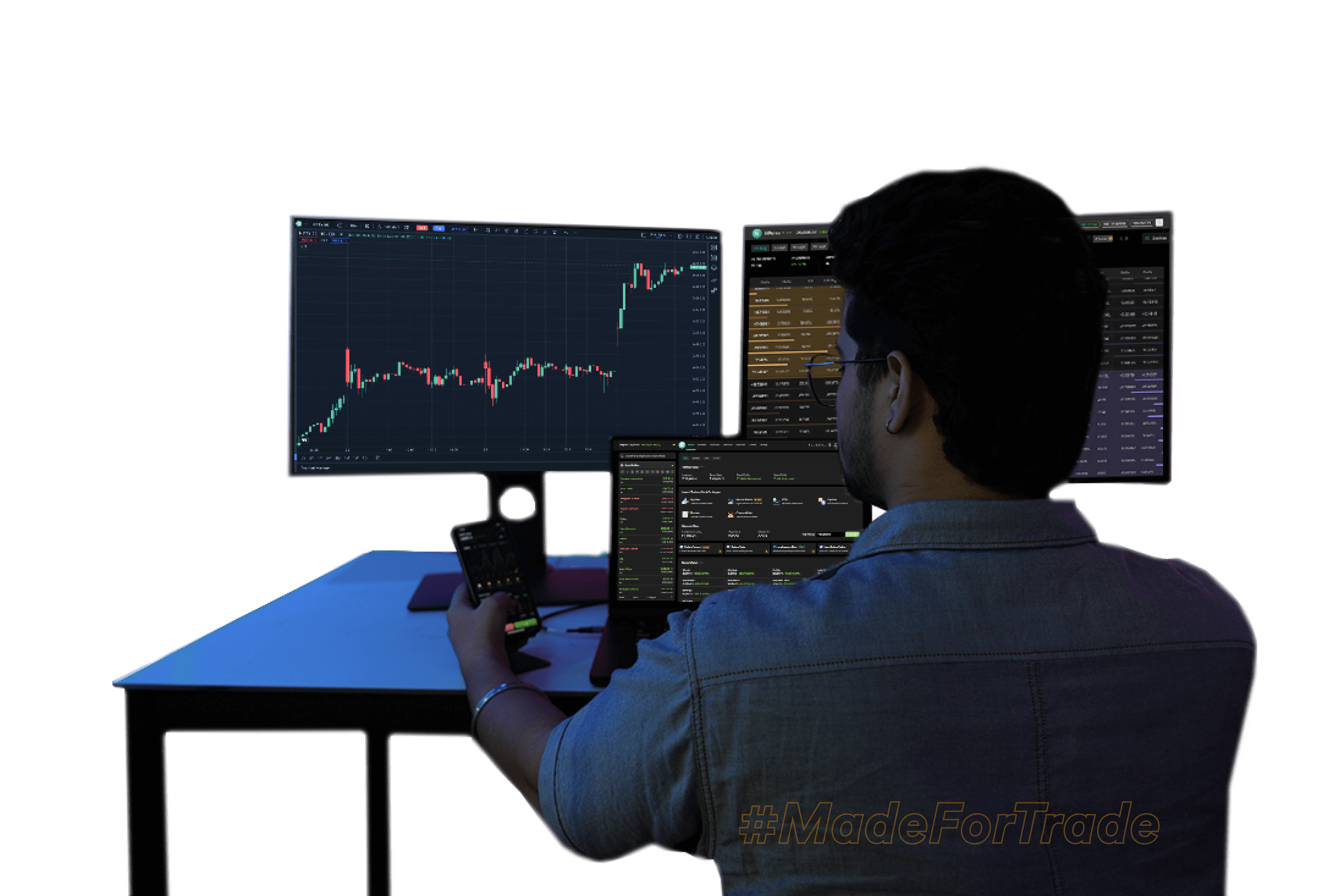

Dhan Web

Web Trading Platform for those who love to trade from the big screen.

Options Trader App

Option Trading App built especially for India's F&O Traders.

Options Trader Web

Option Trading Platform to build, analyze, & execute F&O trades.

Trade from tv.dhan.co

Trade with TradingView Chart features for FREE on tv.dhan.co.

Connect to TradingView

Connect Dhan to TradingView - Place orders from tradingview.com

DhanHQ Trading APIs

Trade with Algo, Connect Apps, Build Services using APIs for FREE.

smallcases on Dhan

Build wealth with smallcase investment for FREE on Dhan.

Margin Trading Facility

Get 5X Leverage on 1700+ stocks. Trade Now, Pay Later.

ScanX Stock Screener

50+ Readymade Screeners, Live Market Insights & Instant Trade Execution.

Rent Stocks via SLBM

Earn up to 35% p.a. over & above your portfolio holdings!

Stocks

MTF, Instant Pledge, & more for online stock trading.

Commodity

Dashboard, Pledge Margin, & Charts for commodity trading.

Options

Strategy Builder, Flash Trade, & Margin for options trading.

Futures

Charts, Futures Chain, & Margin for futures trading.

ETFs

SIP, Forever Order, & Draft Order for investing in ETFs.

Mutual Funds

Invest in top rated direct mutual funds at 0% commission.

IPO

Apply for Upcoming IPO, Open IPO and SME IPO using mobile UPI in seconds!

NFO

Apply for NFOs directly at no extra cost.

- Indices

- Stocks

- F&O

- Mutual Funds

- ETFs

- Tools & Calculators

Pricing

Open Free Demat with ₹0 AMC for Life-time! Get detailed pricing here.

Become a Partner

Join our growing network of authorised partners - lets grow together!

fuzz

Ask anything on finance, money or markets - Your AI-powered research partner.

Dhan Support

Browse through most commonly asked questions and get answer instantly.

Dhan Blog

Read about markets, trading strategies, investing & more.

Indicator by Dhan

Your bi-monthly trading deep dive into markets, insights, and strategies.

MadeForTrade Community

Be a part of India’s most active community of Super Traders & Long-Term Investors.

Gift Nifty

Gift Nifty

Dhan App

Dhan App Chrome

Chrome