B

BSE Momentum Index

BSEMOI Share Price

BSE

2,114.34

Last Updated on 04 Mar 2026 at 16:59

Open at

2,113.23

52W High

2,323.97

52W Low

1,763.06

Get 10+ Layouts, 100+ Indicators, Custom Timeframes & All Drawing Tools for FREE.

BSEMOI Performance

Markets Today

High

2,124.91

Low

2,097.71

Open at

2,113.23

Prev Close

2,152.68

Volumes

0

Avg Price

0.00

Lower Circuit

0.00

Upper Circuit

0.00

Last Traded Details

Quantity

0

Time

16:59:55

Price Movement

0.79%down side

0.79%down side

Historical Performance

3 M High

2,258.99

3 M Low

2,049.68

1 Yr High

2,323.97

1 Yr Low

1,763.06

3 Yr High

2,484.21

3 Yr Low

1,047.43

5 Yr High

2,484.21

5 Yr Low

994.87

1-Year Performance

0.79%down side

0.79%down side

Market Insights

Positive Stocks

3

Negative Stocks

27

Neutral Stocks

0

BSEMOI Latest News

BSEMOI Technicals

Moving Averages

| Period | Simple | Signal |

|---|---|---|

| 5-SMA | 00 | Bullish |

| 10-SMA | 00 | Bullish |

| 20-SMA | 00 | Bullish |

| 50-SMA | 00 | Bullish |

| 100-SMA | 00 | Bullish |

| 200-SMA | 00 | Bullish |

Technical Indicators

| Indicator | Value | Action |

|---|---|---|

| RSI(14) | 00 | Bullish |

| ATR(14) | 00 | Bullish |

| STOCH(14) | 00 | Bullish |

| STOCH RSI(14) | 00 | Bullish |

| MACD(12,26) | 00 | Bullish |

| ADX(14) | 00 | Bullish |

Summary of Technical Indicators for BSEMOI

BSEMOI Companies

Sorry, No Data Available at this Moment!

BSEMOI Sector Weightage

View All Sector

Sectors | Companies | Weightage | Market Cap (Cr.) |

|---|---|---|---|

Banks | 2 | 35.11% | 23,11,640.35 |

Telecom | 2 | 17.70% | 11,65,248.93 |

Financial Services | 4 | 13.77% | 9,06,702.42 |

Aerospace & Defense | 2 | 6.96% | 4,58,016.20 |

Retail | 1 | 3.53% | 2,32,283.94 |

Aviation | 1 | 2.58% | 1,69,817.65 |

Healthcare | 4 | 6.48% | 4,26,512.96 |

Capital Markets | 1 | 1.66% | 1,09,430.68 |

Capital Goods | 2 | 3.08% | 2,02,464.66 |

Healthcare Services | 2 | 2.60% | 1,71,159.65 |

Chemicals | 2 | 1.73% | 1,13,662.42 |

Metals & Mining | 1 | 0.94% | 61,610.15 |

Consumer Goods | 2 | 1.33% | 87,512.14 |

Insurance | 1 | 0.92% | 60,595.25 |

Construction | 2 | 1.04% | 68,193.19 |

Information Technology | 1 | 0.60% | 39,193.19 |

BSEMOI Share Price History

View Price History

BSEMOI Historical Returns

Sorry, No Data Available at this Moment!

BSEMOI Investment Returns

Short Term

1 Week

1 Month

3 Month

6 Month

9 Month

Long Term

1 Year

2 Years

3 Years

4 Years

5 Years

- In Short Term

- In Long term

1 Week

1 Month

3 Month

6 Month

9 Month

Create Wealth in Longterm with Weekly and Monthly SIP in Stocks.

BSEMOI Comparison

Sorry, No Data Available at this Moment!

Sorry, No Data Available at this Moment!

BSEMOI ETF

Sorry, No Data Available at this Moment!

NSE Indices Today

All NSE Indices

BSE Indices Today

All BSE Indices

Top Gainers Today

View All Gainers

Top Losers Today

View All Losers

Open IPOs

View All

FAQs on BSEMOI

How many companies are in BSE Momentum Index?

What is the BSE Momentum Index share price today?

What are the historical returns of BSE Momentum Index?

- Past 1 year: 15.41%

- Past 3 years: 94.09%

- Past 5 years: 77.31%

What is the market capitalization of BSE Momentum Index?

Can you buy BSE Momentum Index directly?

Is it possible to purchase the stocks of BSE Momentum Index?

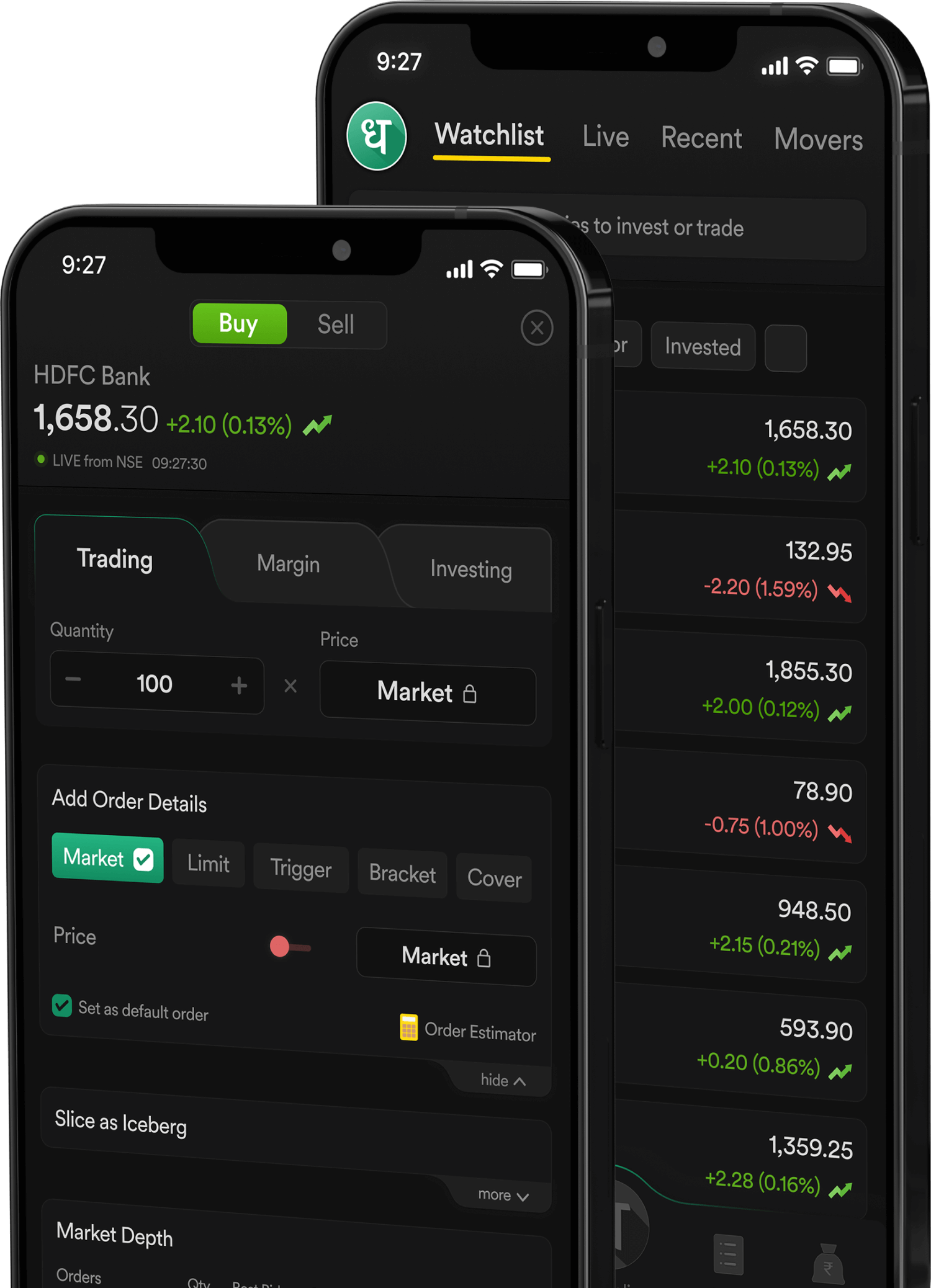

How to buy the stocks of BSE Momentum Index on Dhan?

- Download the Dhan App to open a Open Demat Account

- Navigate to the “Money Tab”

- Add money to your account

- Search for the stock you want to buy

- Tap on “Buy”.

Dhan App

Dhan App Chrome

Chrome