S

Sensex

SENSEX Share Price

BSE

81,481.86

Last Updated on 30 Jul 2025 at 17:00

Open at

81,594.52

52W High

85,978.25

52W Low

71,425.01

Get 10+ Layouts, 100+ Indicators, Custom Timeframes & All Drawing Tools for FREE.

SENSEX Performance

Markets Today

High

81,618.96

Low

81,187.06

Open at

81,594.52

Prev Close

81,337.95

Volumes

0

Avg Price

0.00

Lower Circuit

0.00

Upper Circuit

0.00

Last Traded Details

Quantity

0

Time

17:00:01

Price Movement

0.36%down side

0.36%down side

Historical Performance

3 M High

84,099.53

3 M Low

78,968.34

1 Yr High

85,978.25

1 Yr Low

71,425.01

3 Yr High

85,978.25

3 Yr Low

56,314.05

5 Yr High

85,978.25

5 Yr Low

36,495.98

1-Year Performance

0.36%down side

0.36%down side

Market Insights

Positive Stocks

15

Negative Stocks

15

Neutral Stocks

0

SENSEX Latest News

Tata Motors to Acquire Iveco Group for €3.8 Billion in All-Cash Deal

Tata Motors has announced plans to acquire 100% of Iveco Group N.V. (excluding defence business) through a voluntary tender offer at €14.1 per share, valuing the transaction at €3.8 billion. The acquisition covers Iveco's industrials business including trucks, buses, and powertrain operations, plus financial services, which generated €14.1 billion in revenue and €891 million adjusted EBIT in 2024. The deal is backed by Exor's irrevocable commitment to tender all shares and has board recommendation. Funding will be secured through bridge financing from Morgan Stanley and MUFG, expected to be syndicated and refinanced with equity and long-term debt. The transaction requires regulatory approvals including merger control, FDI, and EU foreign subsidies regulations, with closure expected by April 2026. The combined entity will create a global commercial vehicle platform with 545,000 units annual volume and €207 billion revenue. Tata Motors expects annual free cash flow synergies up to 0.5% of consolidated revenue from 2028, with plans to reach EPS breakeven in 2 years and repay acquisition debt in 4 years.

Tata Motors Incorporates New Step-Down Subsidiary TML CV Holdings B.V in Netherlands

Tata Motors announced the incorporation of a new step-down subsidiary, TML CV Holdings B.V, in the Netherlands through its wholly-owned subsidiary TML CV Holdings Pte. Limited. The board meeting of TML CV Holdings Pte. Limited approved the incorporation on July 30, 2025. The new subsidiary will function as a holding company with the primary objective of participating in managing and administering participations and interests in businesses, legal entities and companies. TML CV Holdings Pte. Limited will hold 100% shareholding in the new entity through cash consideration at par value. The incorporation requires no specific governmental or regulatory approvals.

Tata Motors Acquires Iveco Ex Defense for €3.8 Billion Cash Deal

Tata Motors announced its acquisition of Iveco Ex Defense in a cash transaction valued at €3.8 billion. The purchase price is set at €14.1 per share, with the entire transaction being conducted in cash.

M&M Announces Long-Term Growth Strategy Through FY26 Focusing on SUV, Tractor, and EV Expansion

Mahindra & Mahindra has announced a long-term growth strategy extending to FY26, emphasizing profitable expansion across multiple business segments. The strategy builds on the company's record market share in SUVs and tractors, along with its leadership position in electric vehicles. The plan also includes robust developments across TechM, MMFSL, and real assets divisions, with a focus on profitable growth across all business units.

Tata Steel Announces ₹11,500 Cr Cost Transformation and 40 MTPA Expansion Plan

Tata Steel has outlined a growth strategy featuring a ₹11,500 crore cost transformation initiative, expansion to 40 million tonnes per annum (MTPA) capacity, and a focus on green steel production. The company is positioning itself for future growth through these strategic initiatives.

View More

SENSEX Technicals

Moving Averages

| Period | Simple | Signal |

|---|---|---|

| 5-SMA | 63.28 | Bullish |

| 10-SMA | 64.67 | Bearish |

| 20-SMA | 64.75 | Bearish |

| 50-SMA | 66.20 | Bearish |

| 100-SMA | 64.26 | Bearish |

| 200-SMA | 65.54 | Bearish |

Technical Indicators

| Indicator | Value | Action |

|---|---|---|

| RSI(14) | 47.33 | Neutral |

| ATR(14) | 3.59 | Less Volatile |

| STOCH(9,6) | 30.41 | Neutral |

| STOCH RSI(14) | 16.45 | Oversold |

| MACD(12,26) | -0.20 | Bearish |

| ADX(14) | 27.85 | Strong Trend |

Summary of Technical Indicators for SENSEX

SENSEX Companies

| SENSEX Gainers | LTP | Change% | Weightage | Market Cap (Cr.) | PE Ratio | 52W High | 52W Low |

|---|---|---|---|---|---|---|---|

L Larsen & Toubro | 3,665.15 | 4.87% | 3.151% | ₹ 5,04,089.86 | 31.00 | 3,963.00 | 2,967.65 |

S Sun Pharmaceutical | 1,734.95 | 1.41% | 2.602% | ₹ 4,16,272.62 | 35.83 | 1,960.20 | 1,555.00 |

N NTPC | 338.65 | 1.26% | 2.053% | ₹ 3,28,377.60 | 13.84 | 448.30 | 292.70 |

M Maruti Suzuki | 12,622.35 | 1.19% | 2.481% | ₹ 3,96,849.93 | 27.05 | 13,675.00 | 10,725.00 |

B Bharti Airtel | 1,934.75 | 0.87% | 6.897% | ₹ 11,03,214.83 | 51.09 | 2,045.50 | 1,422.30 |

T Trent | 5,042.00 | 0.83% | 1.120% | ₹ 1,79,236.78 | 122.74 | 8,345.85 | 4,491.75 |

A Axis Bank | 1,072.20 | 0.63% | 2.079% | ₹ 3,32,497.52 | 11.86 | 1,281.75 | 934.00 |

M Mahindra & Mahindra | 3,217.05 | 0.62% | 2.487% | ₹ 3,97,854.60 | 30.75 | 3,302.90 | 2,360.45 |

A Asian Paints | 2,415.15 | 0.56% | 1.448% | ₹ 2,31,660.65 | 59.82 | 3,394.00 | 2,125.00 |

T Tech Mahindra | 1,460.00 | 0.42% | 0.894% | ₹ 1,42,955.11 | 31.35 | 1,807.40 | 1,209.70 |

S State Bank of India | 801.85 | 0.37% | 4.474% | ₹ 7,15,620.66 | 9.51 | 881.50 | 679.65 |

I Infosys | 1,519.05 | 0.34% | 3.945% | ₹ 6,31,054.78 | 23.07 | 2,006.80 | 1,307.10 |

U UltraTech Cement | 12,245.60 | 0.23% | 2.256% | ₹ 3,60,852.33 | 52.00 | 12,711.95 | 10,053.00 |

H HDFC Bank | 2,025.60 | 0.16% | 9.710% | ₹ 15,53,212.59 | 21.99 | 2,035.00 | 1,593.20 |

H HCL Technologies | 1,475.75 | 0.16% | 2.503% | ₹ 4,00,469.13 | 23.55 | 2,011.00 | 1,304.00 |

SENSEX Sector Weightage

View All Sector

Sectors | Companies | Weightage | Market Cap (Cr.) |

|---|---|---|---|

Banks | 5 | 25.31% | 40,48,190.03 |

Information Technology | 4 | 14.25% | 22,79,280.13 |

Petroleum Products | 1 | 11.93% | 19,07,943.32 |

Telecom | 1 | 6.90% | 11,03,214.83 |

FMCG | 2 | 6.77% | 10,82,796.05 |

Automobiles | 3 | 6.51% | 10,40,773.47 |

Construction | 2 | 5.41% | 8,64,942.19 |

Financial Services | 2 | 5.40% | 8,63,047.87 |

Power | 2 | 3.76% | 6,00,978.30 |

Consumer Goods | 2 | 3.32% | 5,31,412.77 |

Retail | 2 | 2.95% | 4,72,221.42 |

Healthcare | 1 | 2.60% | 4,16,272.62 |

Transport | 1 | 1.88% | 3,01,134.17 |

Aerospace & Defense | 1 | 1.77% | 2,82,449.85 |

Metals & Mining | 1 | 1.26% | 2,01,846.20 |

SENSEX Share Price History

Close Price

Volume

SENSEX share price in last 10 trading sessions

SENSEX Historical Returns

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Annually |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2025 | -0.82% | -5.55% | 5.76% | 3.65% | 1.51% | 2.65% | -2.71% | NA | NA | NA | NA | NA | 4.09% |

2024 | -0.68% | 1.04% | 1.59% | 1.13% | -0.70% | 6.86% | 3.43% | 0.76% | 2.35% | -5.83% | 0.52% | -2.08% | 8.17% |

2023 | -2.12% | -0.99% | 0.05% | 3.60% | 2.47% | 3.35% | 2.80% | -2.55% | 1.54% | -2.97% | 4.87% | 7.84% | 18.74% |

2022 | -0.41% | -3.05% | 4.13% | -2.57% | -2.62% | -4.58% | 8.58% | 3.42% | -3.54% | 5.78% | 3.87% | -3.58% | 4.44% |

2021 | -3.07% | 6.08% | 0.83% | -1.47% | 6.47% | 1.05% | 0.20% | 9.44% | 2.73% | 0.31% | -3.78% | 2.08% | 21.99% |

2020 | -1.29% | -5.96% | -23.05% | 14.42% | -3.84% | 7.68% | 7.71% | 2.72% | -1.45% | 4.06% | 11.45% | 8.16% | 15.75% |

2019 | 0.52% | -1.07% | 7.82% | 0.93% | 1.75% | -0.80% | -4.86% | -0.40% | 3.57% | 3.78% | 1.66% | 1.13% | 14.38% |

2018 | 5.60% | -4.95% | -3.56% | 6.65% | 0.46% | 0.29% | 6.16% | 2.76% | -6.26% | -4.93% | 5.09% | -0.35% | 5.91% |

2017 | 3.87% | 3.93% | 3.05% | 1.01% | 4.10% | -0.72% | 5.15% | -2.41% | -1.41% | 6.17% | -0.19% | 2.74% | 27.91% |

2016 | -4.77% | -7.51% | 10.17% | 1.04% | 4.14% | 1.24% | 3.90% | 1.43% | -2.06% | 0.23% | -4.57% | -0.10% | 1.95% |

SENSEX Investment Returns

Short Term

1 Week

1 Month

3 Month

6 Month

9 Month

Long Term

1 Year

2 Years

3 Years

4 Years

5 Years

- In Short Term

- In Long term

1 Week

1 Month

3 Month

6 Month

9 Month

Create Wealth in Longterm with Weekly and Monthly SIP in Stocks.

Name | LTP | Change | Change % | 1M Returns | 3M Returns | 6M Returns | 1Y Returns | 3Y Returns | 5Y Returns |

|---|---|---|---|---|---|---|---|---|---|

S Sensex | ₹ 81,481.86 | 143.91 | 0.18% | -2.54% | 1.54% | 6.15% | 0.03% | 40.21% | 115.93% |

L Larsen & Toubro | ₹ 3,665.10 | 169.50 | 4.85% | -0.13% | - | - | -3.16% | - | - |

S Sun Pharmaceutical | ₹ 1,733.80 | 23.30 | 1.36% | 3.47% | - | - | 1.89% | - | - |

N NTPC | ₹ 338.80 | 4.20 | 1.26% | 1.16% | - | - | -16.75% | - | - |

M Maruti Suzuki | ₹ 12,618.00 | 149.00 | 1.19% | 1.76% | - | - | -1.99% | - | - |

T Tata Consumer Products | ₹ 1,073.10 | 11.50 | 1.08% | -2.35% | - | - | -10.19% | - | - |

A Axis Bank | ₹ 1,073.30 | 9.10 | 0.86% | -10.50% | - | - | -8.26% | - | - |

T Trent | ₹ 5,043.50 | 42.00 | 0.84% | -18.88% | - | - | -10.27% | - | - |

B Bharti Airtel | ₹ 1,932.60 | 14.30 | 0.75% | -3.83% | - | - | 31.44% | - | - |

T Tech Mahindra | ₹ 1,463.20 | 9.40 | 0.65% | -13.27% | - | - | -4.87% | - | - |

A Asian Paints | ₹ 2,415.80 | 14.30 | 0.60% | 3.19% | - | - | -19.61% | - | - |

G Grasim Industries | ₹ 2,758.60 | 15.60 | 0.57% | -3.02% | - | - | -1.16% | - | - |

U UltraTech Cement | ₹ 12,268.00 | 47.00 | 0.38% | 1.45% | - | - | 3.91% | - | - |

N Nestle | ₹ 2,231.50 | 7.80 | 0.35% | -9.48% | - | - | -9.20% | - | - |

I Infosys | ₹ 1,519.00 | 5.30 | 0.35% | -5.17% | - | - | -19.08% | - | - |

S SBI Life Insurance | ₹ 1,839.10 | 5.70 | 0.31% | 0.04% | - | - | 6.86% | - | - |

S State Bank of India | ₹ 801.65 | 2.45 | 0.31% | -2.28% | - | - | -8.15% | - | - |

M Mahindra & Mahindra | ₹ 3,208.90 | 9.50 | 0.30% | 0.81% | - | - | 9.81% | - | - |

J JSW Steel | ₹ 1,037.90 | 3.00 | 0.29% | 1.71% | - | - | 15.05% | - | - |

H HCL Technologies | ₹ 1,476.50 | 4.10 | 0.28% | -14.58% | - | - | -9.43% | - | - |

H HDFC Bank | ₹ 2,025.80 | 4.20 | 0.21% | 1.21% | - | - | 25.39% | - | - |

E Eicher Motors | ₹ 5,481.00 | 10.50 | 0.19% | -3.10% | - | - | 10.69% | - | - |

O Oil & Natural Gas Corporation | ₹ 241.81 | 0.37 | 0.15% | -0.98% | - | - | -27.14% | - | - |

H HDFC Life Insurance | ₹ 757.45 | 1.10 | 0.15% | -6.98% | - | - | 8.64% | - | - |

T Tata Consultancy Services | ₹ 3,053.60 | -2.40 | -0.08% | -11.80% | - | - | -30.05% | - | - |

T Titan | ₹ 3,376.50 | -2.70 | -0.08% | -8.50% | - | - | -2.65% | - | - |

A Apollo Hospitals | ₹ 7,450.00 | -6.00 | -0.08% | 2.87% | - | - | 12.18% | - | - |

A Adani Ports & SEZ | ₹ 1,394.00 | -1.90 | -0.14% | -3.88% | - | - | -9.85% | - | - |

B Bajaj Finance | ₹ 884.85 | -1.70 | -0.19% | -5.52% | - | - | 29.67% | - | - |

T Tata Steel | ₹ 161.36 | -0.33 | -0.20% | 1.00% | - | - | -1.65% | - | - |

I ITC | ₹ 407.60 | -0.85 | -0.21% | -2.13% | - | - | -12.05% | - | - |

J Jio Financial Services | ₹ 320.30 | -0.80 | -0.25% | -1.97% | - | - | -2.75% | - | - |

I ICICI Bank | ₹ 1,482.40 | -3.80 | -0.26% | 2.53% | - | - | 22.57% | - | - |

B Bharat Electronics | ₹ 386.50 | -1.75 | -0.45% | -8.30% | - | - | 21.50% | - | - |

R Reliance Industries | ₹ 1,410.10 | -7.00 | -0.49% | -6.03% | - | - | -6.81% | - | - |

H Hindalco Industries | ₹ 688.80 | -3.90 | -0.56% | -0.58% | - | - | 4.28% | - | - |

A Adani Enterprises | ₹ 2,532.90 | -15.00 | -0.59% | -3.30% | - | - | -19.04% | - | - |

D Dr Reddys Laboratories | ₹ 1,292.10 | -7.70 | -0.59% | 0.69% | - | - | -5.05% | - | - |

W Wipro | ₹ 250.20 | -1.60 | -0.64% | -5.93% | - | - | -4.05% | - | - |

B Bajaj Finserv | ₹ 1,959.80 | -12.80 | -0.65% | -4.68% | - | - | 19.31% | - | - |

K Kotak Bank | ₹ 1,959.70 | -13.00 | -0.66% | -9.42% | - | - | 9.72% | - | - |

H Hindustan Unilever | ₹ 2,437.40 | -16.20 | -0.66% | 6.22% | - | - | -9.44% | - | - |

I Indusind Bank | ₹ 801.90 | -6.30 | -0.78% | -8.05% | - | - | -43.91% | - | - |

S Shriram Finance | ₹ 632.80 | -5.55 | -0.87% | -10.48% | - | - | 8.65% | - | - |

C Cipla | ₹ 1,559.40 | -14.60 | -0.93% | 3.55% | - | - | 1.99% | - | - |

C Coal India | ₹ 379.90 | -3.75 | -0.98% | -3.07% | - | - | -26.85% | - | - |

E Eternal | ₹ 303.45 | -3.10 | -1.01% | 14.88% | - | - | 33.60% | - | - |

B Bajaj Auto | ₹ 8,043.50 | -84.00 | -1.03% | -3.97% | - | - | -15.90% | - | - |

P Power Grid Corporation of India | ₹ 288.95 | -4.15 | -1.42% | -3.65% | - | - | -17.40% | - | - |

H Hero Motocorp | ₹ 4,251.30 | -73.90 | -1.71% | 0.34% | - | - | -21.91% | - | - |

T Tata Motors | ₹ 668.45 | -23.90 | -3.45% | -2.84% | - | - | -42.47% | - | - |

Name | LTP | Change% | High | Low |

|---|---|---|---|---|

S Sensex | ₹ 81,481.86 | 0.18% | ₹ 81,618.96 | ₹ 81,187.06 |

L Larsen & Toubro | ₹ 3,665.15 | 4.87% | ₹ 3,685.00 | ₹ 3,593.60 |

S Sun Pharmaceutical | ₹ 1,734.95 | 1.41% | ₹ 1,739.90 | ₹ 1,712.50 |

N NTPC | ₹ 338.65 | 1.26% | ₹ 342.20 | ₹ 332.80 |

M Maruti Suzuki | ₹ 12,622.35 | 1.19% | ₹ 12,634.95 | ₹ 12,399.55 |

B Bharti Airtel | ₹ 1,934.75 | 0.87% | ₹ 1,939.00 | ₹ 1,922.45 |

T Trent | ₹ 5,042.00 | 0.83% | ₹ 5,072.55 | ₹ 4,986.40 |

A Axis Bank | ₹ 1,072.20 | 0.63% | ₹ 1,080.50 | ₹ 1,062.00 |

M Mahindra & Mahindra | ₹ 3,217.05 | 0.62% | ₹ 3,241.05 | ₹ 3,152.45 |

A Asian Paints | ₹ 2,415.15 | 0.56% | ₹ 2,442.70 | ₹ 2,366.65 |

T Tech Mahindra | ₹ 1,460.00 | 0.42% | ₹ 1,466.30 | ₹ 1,449.00 |

About Sensex

Sensex is short for the Stock Exchange Sensitive Index. It is the benchmark index of the Bombay Stock Exchange (BSE), which is one of the oldest stock exchanges in Asia. Launched on 1st Jan, 1986, it was designed to provide a clear and reliable measure of the Indian stock market's performance. The index comprises 30 of the largest and most actively traded companies listed on the BSE. It serves as an important indicator of market sentiment, helping investors assess the health and trends of the Indian economy.

What is Sensex Based On?

Selection Criteria for Stocks in Sensex

- The company must be listed on the BSE for at least 6 months

- It should rank high by average six-month free-float market capitalization

- The stock must have high liquidity and consistent trading activity

- The company should generate substantial revenue from core business activities

- Sectoral balance is considered to ensure broad market representation

How Often Do Stocks in Sensex Change?

Who Maintains the Sensex?

What Sensex Tells Us?

Is Sensex a Benchmark?

SENSEX Mutual Funds

View All Index Funds

Name | NAV | AUM (Cr.) | 1Y Return | 3Y Returns | 5Y Returns | Expense Ratio |

|---|---|---|---|---|---|---|

Kotak Small Cap Fund Direct - Growth | ₹ 310.2570 | ₹ 18,031.00 | -3.24% | 20.01% | 33.08% | 0.53% |

Kotak Infrastructure and Economic Reform Fund Direct - Growth | ₹ 77.5000 | ₹ 2,449.76 | -7.81% | 26.56% | 32.99% | 0.66% |

Kotak Midcap Fund Direct - Growth | ₹ 158.2650 | ₹ 57,102.00 | 4.04% | 24.54% | 31.05% | 0.38% |

Kotak Pioneer Fund Direct - Growth | ₹ 34.5550 | ₹ 2,957.73 | 8.40% | 24.38% | 26.60% | 0.49% |

Kotak Contra Fund Direct - Growth | ₹ 176.0360 | ₹ 4,502.48 | -0.90% | 23.54% | 25.47% | 0.58% |

Kotak Large & Midcap Fund Direct - Growth | ₹ 392.0340 | ₹ 28,294.10 | 0.49% | 21.44% | 24.47% | 0.55% |

Kotak ELSS Tax Saver Fund Direct - Growth | ₹ 135.5720 | ₹ 6,492.65 | -2.33% | 18.84% | 23.24% | 0.63% |

Kotak Aggressive Hybrid Fund Direct - Growth | ₹ 73.4640 | ₹ 7,808.18 | 3.60% | 17.87% | 21.83% | 0.47% |

Kotak Focused Fund Direct - Growth | ₹ 27.6950 | ₹ 3,707.11 | 1.61% | 17.84% | 21.69% | 0.55% |

Kotak Multi Asset Allocator FoF - Dynamic Fund Direct - Growth | ₹ 250.5810 | ₹ 1,859.89 | 7.38% | 20.45% | 21.07% | 0.84% |

Kotak Small Cap Fund Direct - Growth

AUM

1Y Returns

-3.24%

3Y Returns

20.01%

5Y Returns

33.08%

Kotak Infrastructure and Economic Reform Fund Direct - Growth

AUM

1Y Returns

-7.81%

3Y Returns

26.56%

5Y Returns

32.99%

Kotak Midcap Fund Direct - Growth

AUM

1Y Returns

4.04%

3Y Returns

24.54%

5Y Returns

31.05%

Kotak Pioneer Fund Direct - Growth

AUM

1Y Returns

8.40%

3Y Returns

24.38%

5Y Returns

26.60%

Kotak Contra Fund Direct - Growth

AUM

1Y Returns

-0.90%

3Y Returns

23.54%

5Y Returns

25.47%

Kotak Large & Midcap Fund Direct - Growth

AUM

1Y Returns

0.49%

3Y Returns

21.44%

5Y Returns

24.47%

Kotak ELSS Tax Saver Fund Direct - Growth

AUM

1Y Returns

-2.33%

3Y Returns

18.84%

5Y Returns

23.24%

Kotak Aggressive Hybrid Fund Direct - Growth

AUM

1Y Returns

3.60%

3Y Returns

17.87%

5Y Returns

21.83%

Kotak Focused Fund Direct - Growth

AUM

1Y Returns

1.61%

3Y Returns

17.84%

5Y Returns

21.69%

Kotak Multi Asset Allocator FoF - Dynamic Fund Direct - Growth

AUM

1Y Returns

7.38%

3Y Returns

20.45%

5Y Returns

21.07%

SENSEX ETF

NSE Indices Today

All NSE Indices

R

Reliance Industries

1,410.10

H

HDFC Bank

2,025.80

T

Tata Consultancy Services

3,053.60

B

Bharti Airtel

1,932.60

S

State Bank of India

801.65

I

Infosys

1,519.00

H

Hindustan Unilever

2,437.40

B

Bajaj Finance

884.85

I

ITC

407.60

L

Larsen & Toubro

3,665.10

S

Sun Pharmaceutical

1,733.80

H

HCL Technologies

1,476.50

M

Mahindra & Mahindra

3,208.90

M

Maruti Suzuki

12,618.00

K

Kotak Bank

1,959.70

U

UltraTech Cement

12,268.00

A

Axis Bank

1,073.30

N

NTPC

338.80

B

Bajaj Finserv

1,959.80

O

Oil & Natural Gas Corporation

241.81

A

Adani Ports & SEZ

1,394.00

T

Titan

3,376.50

E

Eternal

303.45

A

Adani Enterprises

2,532.90

B

Bharat Electronics

386.50

P

Power Grid Corporation of India

288.95

W

Wipro

250.20

J

JSW Steel

1,037.90

T

Tata Motors

668.45

C

Coal India

379.90

A

Asian Paints

2,415.80

B

Bajaj Auto

8,043.50

N

Nestle

2,231.50

J

Jio Financial Services

320.30

T

Tata Steel

161.36

G

Grasim Industries

2,758.60

S

SBI Life Insurance

1,839.10

T

Trent

5,043.50

H

HDFC Life Insurance

757.45

H

Hindalco Industries

688.80

E

Eicher Motors

5,481.00

T

Tech Mahindra

1,463.20

C

Cipla

1,559.40

S

Shriram Finance

632.80

D

Dr Reddys Laboratories

1,292.10

A

Apollo Hospitals

7,450.00

T

Tata Consumer Products

1,073.10

H

Hero Motocorp

4,251.30

I

Indusind Bank

801.90

BSE Indices Today

All BSE Indices

R

Reliance Industries

1,410.10

H

HDFC Bank

2,025.80

T

Tata Consultancy Services

3,053.60

B

Bharti Airtel

1,932.60

S

State Bank of India

801.65

I

Infosys

1,519.00

H

Hindustan Unilever

2,437.40

B

Bajaj Finance

884.85

I

ITC

407.60

L

Larsen & Toubro

3,665.10

S

Sun Pharmaceutical

1,733.80

H

HCL Technologies

1,476.50

M

Mahindra & Mahindra

3,208.90

M

Maruti Suzuki

12,618.00

K

Kotak Bank

1,959.70

U

UltraTech Cement

12,268.00

A

Axis Bank

1,073.30

N

NTPC

338.80

B

Bajaj Finserv

1,959.80

O

Oil & Natural Gas Corporation

241.81

A

Adani Ports & SEZ

1,394.00

T

Titan

3,376.50

E

Eternal

303.45

A

Adani Enterprises

2,532.90

B

Bharat Electronics

386.50

P

Power Grid Corporation of India

288.95

W

Wipro

250.20

J

JSW Steel

1,037.90

T

Tata Motors

668.45

C

Coal India

379.90

A

Asian Paints

2,415.80

B

Bajaj Auto

8,043.50

N

Nestle

2,231.50

J

Jio Financial Services

320.30

T

Tata Steel

161.36

G

Grasim Industries

2,758.60

S

SBI Life Insurance

1,839.10

T

Trent

5,043.50

H

HDFC Life Insurance

757.45

H

Hindalco Industries

688.80

E

Eicher Motors

5,481.00

T

Tech Mahindra

1,463.20

C

Cipla

1,559.40

S

Shriram Finance

632.80

D

Dr Reddys Laboratories

1,292.10

A

Apollo Hospitals

7,450.00

T

Tata Consumer Products

1,073.10

H

Hero Motocorp

4,251.30

I

Indusind Bank

801.90

Top Gainers Today

View All Gainers

R

Reliance Industries

1,410.10

H

HDFC Bank

2,025.80

T

Tata Consultancy Services

3,053.60

B

Bharti Airtel

1,932.60

S

State Bank of India

801.65

I

Infosys

1,519.00

H

Hindustan Unilever

2,437.40

B

Bajaj Finance

884.85

I

ITC

407.60

L

Larsen & Toubro

3,665.10

S

Sun Pharmaceutical

1,733.80

H

HCL Technologies

1,476.50

M

Mahindra & Mahindra

3,208.90

M

Maruti Suzuki

12,618.00

K

Kotak Bank

1,959.70

U

UltraTech Cement

12,268.00

A

Axis Bank

1,073.30

N

NTPC

338.80

B

Bajaj Finserv

1,959.80

O

Oil & Natural Gas Corporation

241.81

A

Adani Ports & SEZ

1,394.00

T

Titan

3,376.50

E

Eternal

303.45

A

Adani Enterprises

2,532.90

B

Bharat Electronics

386.50

P

Power Grid Corporation of India

288.95

W

Wipro

250.20

J

JSW Steel

1,037.90

T

Tata Motors

668.45

C

Coal India

379.90

A

Asian Paints

2,415.80

B

Bajaj Auto

8,043.50

N

Nestle

2,231.50

J

Jio Financial Services

320.30

T

Tata Steel

161.36

G

Grasim Industries

2,758.60

S

SBI Life Insurance

1,839.10

T

Trent

5,043.50

H

HDFC Life Insurance

757.45

H

Hindalco Industries

688.80

E

Eicher Motors

5,481.00

T

Tech Mahindra

1,463.20

C

Cipla

1,559.40

S

Shriram Finance

632.80

D

Dr Reddys Laboratories

1,292.10

A

Apollo Hospitals

7,450.00

T

Tata Consumer Products

1,073.10

H

Hero Motocorp

4,251.30

I

Indusind Bank

801.90

Top Losers Today

View All Losers

R

Reliance Industries

1,410.10

H

HDFC Bank

2,025.80

T

Tata Consultancy Services

3,053.60

B

Bharti Airtel

1,932.60

S

State Bank of India

801.65

I

Infosys

1,519.00

H

Hindustan Unilever

2,437.40

B

Bajaj Finance

884.85

I

ITC

407.60

L

Larsen & Toubro

3,665.10

S

Sun Pharmaceutical

1,733.80

H

HCL Technologies

1,476.50

M

Mahindra & Mahindra

3,208.90

M

Maruti Suzuki

12,618.00

K

Kotak Bank

1,959.70

U

UltraTech Cement

12,268.00

A

Axis Bank

1,073.30

N

NTPC

338.80

B

Bajaj Finserv

1,959.80

O

Oil & Natural Gas Corporation

241.81

A

Adani Ports & SEZ

1,394.00

T

Titan

3,376.50

E

Eternal

303.45

A

Adani Enterprises

2,532.90

B

Bharat Electronics

386.50

P

Power Grid Corporation of India

288.95

W

Wipro

250.20

J

JSW Steel

1,037.90

T

Tata Motors

668.45

C

Coal India

379.90

A

Asian Paints

2,415.80

B

Bajaj Auto

8,043.50

N

Nestle

2,231.50

J

Jio Financial Services

320.30

T

Tata Steel

161.36

G

Grasim Industries

2,758.60

S

SBI Life Insurance

1,839.10

T

Trent

5,043.50

H

HDFC Life Insurance

757.45

H

Hindalco Industries

688.80

E

Eicher Motors

5,481.00

T

Tech Mahindra

1,463.20

C

Cipla

1,559.40

S

Shriram Finance

632.80

D

Dr Reddys Laboratories

1,292.10

A

Apollo Hospitals

7,450.00

T

Tata Consumer Products

1,073.10

H

Hero Motocorp

4,251.30

I

Indusind Bank

801.90

Open IPOs

View All

FAQs

- Past 1 year: 0.03%

- Past 3 years: 40.21%

- Past 5 years: 115.93%

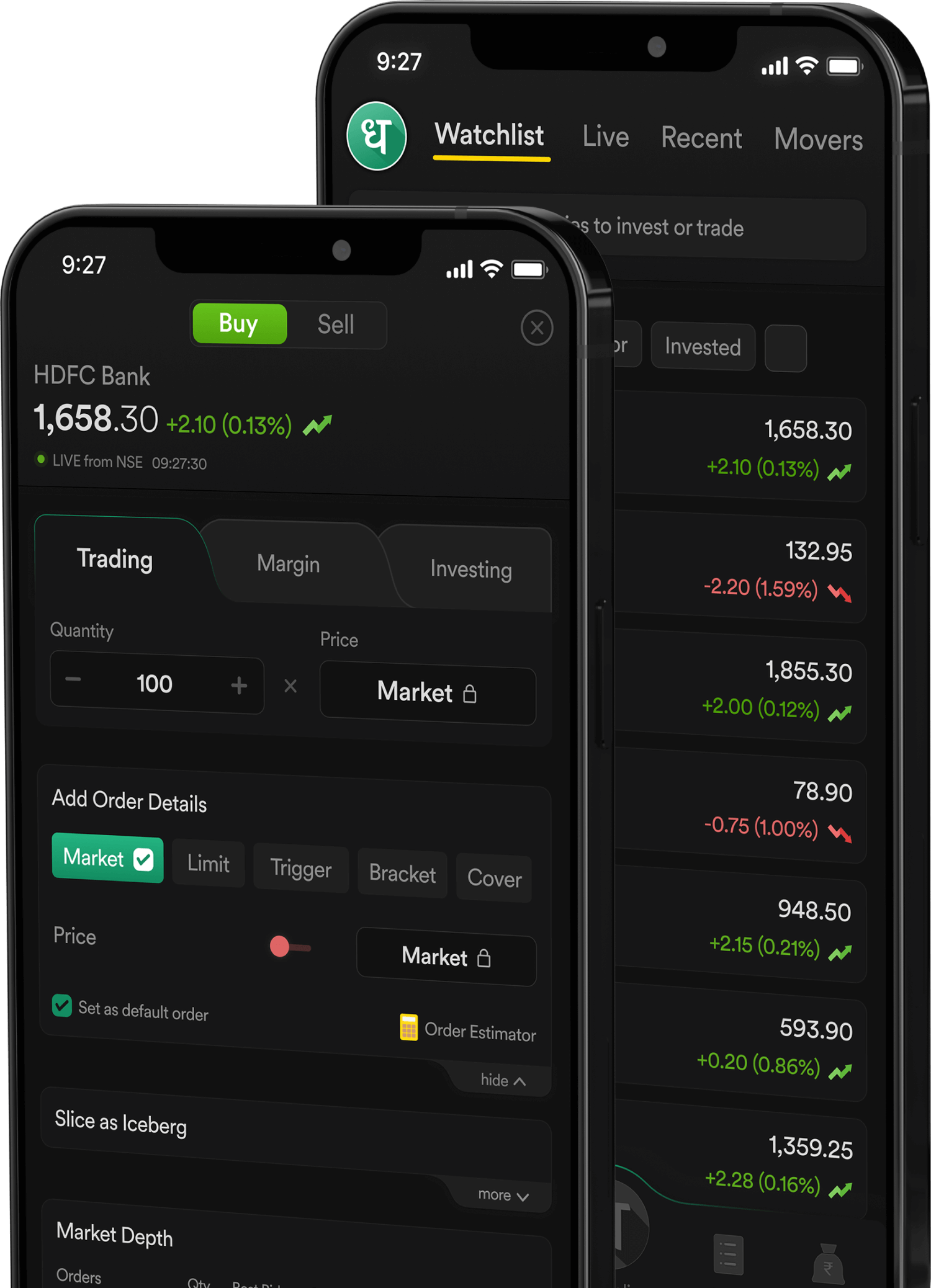

- Download the Dhan App to open a Open Demat Account

- Navigate to the “Money Tab”

- Add money to your account

- Search for the stock you want to buy

- Tap on “Buy”.

SENSEX

Pay Zero Brokerage on Delivery

Open FREE Demat Account

+91

Or Scan the QR Code to download the Dhan App

Explore | Sitemap

*All securities mentioned on this website are exemplary and not recommendatory.

*Current prices on the website are delayed by 15 mins, login to check live prices.

We are bullish on India, we are bullish on India's prospects to be one of the largest economies in the world. We believe that the stock market provides a unique opportunity for all of India's traders and investors to participate in the growth story of the country.

Yet, most investing & trading platforms in India have remained more or less the same over the past decade. Times have changed and retail traders and investors have become smarter about managing their trades and money. Modern traders & investors require an online trading platform that helps them keep up with the technological advancements of our time.

That's why we're building Dhan - to help you trade, to help you invest, and to help you participate in India's growth stock via the stock market with awesome features and an incredible experience.

©2021-2025 Raise Securities Private Limited (formerly Moneylicious Securities Private Limited). All rights reserved. CIN: U74999MH2012PTC433549 Raise Securities is part of Raise Financial Services.

Exchange Membership No. : NSE: 90133 | BSE: 6593 | MCX: 56320

Registered Office: Unit No. 2201, 22nd Floor, Gold Medal Avenue, S.V. Road, Beside Patel Petrol Pump, Piramal Nagar, Goregaon West, Mumbai – 400104

Corporate Office: 302, The Western Edge I, Off Western Express Highway, Borivali East, Mumbai - 400066, Maharashtra, India. Customer Care: 9987761000.

For any query / feedback / clarifications, email at help@dhan.co.

In case of grievances for any of the services rendered by Raise Securities Private Limited, please write to grievance@dhan.co (for NSE, BSE and MCX) or grievancedp@dhan.co (for Depository Participant). Please ensure that you carefully read the Risk Disclosure Document as prescribed by SEBI, our Terms of Use and Privacy Policy. Compliance Officer: Mr. Manish Garg and Mobile: 8655740961 Email: complianceofficer@dhan.co To lodge your complaints using SEBI SCORES, click here.

Disclaimer: All communications with the client via chat, phone, or email are for support purposes only. Any commitments or statements made by the agent (human or virtual) shall not be binding on the company.

DHAN is a brand owned by Raise Securities Private Limited. All DHAN clients are registered under Raise Securities Private Limited. Clients are advised to refer to our company as Raise Securities Private Limited when communicating with regulatory authorities.

Procedure to file a complaint on SEBI SCORES: Register on SCORES portal. Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID. Benefits: Effective Communication, Speedy redressal of the grievances

Disclaimer: Investment in the securities market are subject to market risks, read all the related documents carefully before investing. Brokerage will not exceed the SEBI prescribed limit

Attention investors:

- Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w.e.f September 01, 2020.

- Update your e-mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge.

- Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

Note: As a policy we do not give stock tips or recommendations and have not authorized anyone to give this on behalf of us. If you know anyone claiming to be a part of Dhan / / Raise or our associate companies or partners and offering such services, please report us on help@dhan.co. Important Information for Investors: To prevent unauthorized transactions in your trading / demat account, do not share your account details, credentials or any personal details with anyone. Keep your mobile number updated with your Stock Broker, Depository Participant and ensure that the same is registered with Stock Exchanges, Depository and KRAs. You will receive alerts and information on your registered mobile number / email for debit and other important transactions in your demat account directly from CDSL / Exchange on the same day. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (Stock Broker, DP, Mutual Fund, etc.), you need not undergo the same process again when you approach another intermediary. No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account. This is issued in the interest of investors.

Raise Securities Private Limited also known as Dhan is only an order collection platform that collects orders on behalf of clients and places them on BSE StarMF for execution. Client expressly agrees that Dhan is not liable or responsible and does not represent or warrant any damages regarding non- execution of orders or any incorrect execution of orders with regard to the funds chosen by the client or due to, but not being limited to, any link/system failure, delay in transfer of the funds on account of any unforeseen circumstances/issues in the banking system/payment aggregators or any other problems that may result in a delay in crediting the funds into the BSE Star MF's bank account.

Mutual fund investments are subject to market risks, read all scheme related documents carefully before investing. Dhan is not a distributor or agent of any mutual fund. Mutual Funds are not exchange-traded products. Any related disputes will not have access to the Exchange-investor redressal forum or arbitration mechanism. For other disclaimers please refer https://dhan.co/advertisement-disclaimer/

Download client registration documents (Rights & Obligations, Risk Disclosure Document, Do's & Don'ts) in vernacular language: BSE | NSE | MCX

Kindly, read the Advisory Guidelines of BSE | NSE | MCX for investors as prescribed by the exchange with reference to their circular dated 27th August, 2021 regarding investor awareness and safeguarding client's assets

Important Links: SEBI | BSE | NSE | MCX | CDSL | SCORES | ODR Portal | Investor Charter for Stock Brokers | Investor Charter for DP | UCC Advisory | e-Voting for Shareholders | NCL Client Collateral details |

MCXCCL Client Collateral details

Important Information: Terms of Usage | Disclaimers | Privacy Policy | Grievances | Risk Management Policy | Risk Disclosure | Advertisement Disclaimer | Referral Terms & Conditions | Saarthi 2.0 Mobile App for Investors

Dhan App

Dhan App Chrome

Chrome