V

V Mart Retail

VMART Share Price

Retail516.95

as on 06 Mar 2026 at 15:53

Market Cap

₹4,107 Cr

PE Ratio

32.00

ROCE

14.23%

Today V Mart Retail opened at 530.15 while its previous close was at 526.00. In todays trading session VMART reached a high of 563.55 and low of 513.15. The average traded price for today is 528.31. The 50 DMA stands at 621.16 and 200 DMA is at 756.70. Looking at intraday trend, the stock is in Downtrend.

Get 10+ Layouts, 100+ Indicators, Custom Timeframes & All Drawing Tools for FREE.

VMART Stock Performance

View In-Depth

Markets Today

High

563.55

Low

513.15

Open at

530.15

Prev Close

526.00

Volumes

1,96,110

Avg Price

528.31

Lower Circuit

413.60

Upper Circuit

620.30

Last Traded Details

Quantity

3

Time

15:53:12

Price Movement

0.74%down side

0.74%down side

Historical Performance

3 M High

788.00

3 M Low

513.15

1 Yr High

945.00

1 Yr Low

513.15

3 Yr High

1,130.00

3 Yr Low

398.75

5 Yr High

1,212.20

5 Yr Low

398.75

1-Year Performance

0.74%down side

0.74%down side

VMART Analyst Rating

Buy

Analysts have suggested that investors can

Buy this Stock

- By Refinitiv from 14 analysts

Buy

100%

Hold

0%

Sell

0%

VMART News

View All News

VMART Share Price History

View Price History

VMART Fundamentals

View Fundamentals

Company Valuation

Market Cap (₹ Cr.)

4,107

PE Ratio

32.00

PB Ratio

4.96

Dividend Yield

-

ROE

5.65%

ROCE

14.23%

Book Value (₹)

106.45

Face Value (₹)

10.00

Share Holding Pattern

| Held By | Dec 2024 | Mar 2025 | Jun 2025 | Sep 2025 | Dec 2025 |

|---|---|---|---|---|---|

| Promoters | 44.29% | 44.28% | 44.19% | 44.18% | 44.15% |

| Domestic Institutional Investors (DII) | 32.45% | 32.93% | 31.51% | 32.11% | 32.46% |

| Foreign Institutional Investors (FII) | 17.32% | 17.47% | 18.29% | 17.46% | 17.01% |

| Public Investors | 4.95% | 4.52% | 5.25% | 5.39% | 5.44% |

| Government | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Promoters

Domestic Institutional Investors (DII)

Foreign Institutional Investors (FII)

Public Investors

Government

VMART Return Calculator

Investment of ₹1,00,000 for 5 years would have become

₹ 0

Loss

₹ -1,00,000 (-26.34%)

VMART Investment Returns

View In-Depth

Short Term

1 Week

1 Month

3 Months

6 Months

9 Months

Long Term

1 Year

2 Years

3 Years

4 Years

5 Years

- In Short Term

- In Long term

1 Week

1 Month

3 Months

6 Months

9 Months

Create Wealth in Longterm with Weekly and Monthly SIP in Stocks.

VMART Technicals

View Technicals

Moving Averages

| Period | Simple | Signal |

|---|---|---|

| 5-SMA | 537.73 | Bearish |

| 10-SMA | 555.16 | Bearish |

| 20-SMA | 586.81 | Bearish |

| 50-SMA | 621.16 | Bearish |

| 100-SMA | 713.57 | Bearish |

| 200-SMA | 756.70 | Bearish |

Technical Indicators

| Indicator | Value | Action |

|---|---|---|

| RSI(14) | 26.16 | Neutral |

| ATR(14) | 24.26 | Volatile |

| STOCH(9,6) | 13.39 | Oversold |

| STOCH RSI(14) | 0.00 | Oversold |

| MACD(12,26) | -5.44 | Bearish |

| ADX(14) | 21.66 | Weak Trend |

Summary of Technical Indicators for VMART

Margin on VMART

*Calculated on NSE. Applicable on all exchanges. Margins are subject to change from time to time or may be withdrawn under volatile market conditions. Intraday Orders are square-off automatically at 03:19 pm on NSE / BSE or on hitting 80% of margin utilisation (whichever earlier).

Sorry, No Data Available at this Moment!

VMART Financials

Income Statement

In Crores

Balance Sheet

In Crores

Cash Flow

In Crores

Corporate Actions

The above dates are ex-dates.

View All Stock Events

VMART Revenue Growth

All values are in Crores

Revenue

Profit

Loss

Top Mutual Funds Invested in VMART

| Name | NAV | AUM | Weightage | 1Y Return | 3Y Return | 5Y Return | Expense Ratio |

|---|---|---|---|---|---|---|---|

VMART Similar Stocks

View All

Top Gainers Today

View All Gainers

Top Losers Today

View All Losers

NSE Indices Today

All NSE Indices

BSE Indices Today

All BSE Indices

Open IPOs

View All

Stock Calculators

View All

FAQs on VMART

What is the share price of V Mart Retail?

What is the 52W high and 52W low of V Mart Retail?

What is the return on V Mart Retail share?

- Past 1 year: -28.79%

- Past 3 years: -13.70%

- Past 5 years: -26.34%

What is the PE and PB Ratio of V Mart Retail?

What is the EPS of V Mart Retail?

What is the shareholding pattern of V Mart Retail?

- DIIs - 32.46%

- FII - 17.01%

- Promoters - 44.15%

- Public Investors 5.44%

- Goverenment - 0.00%

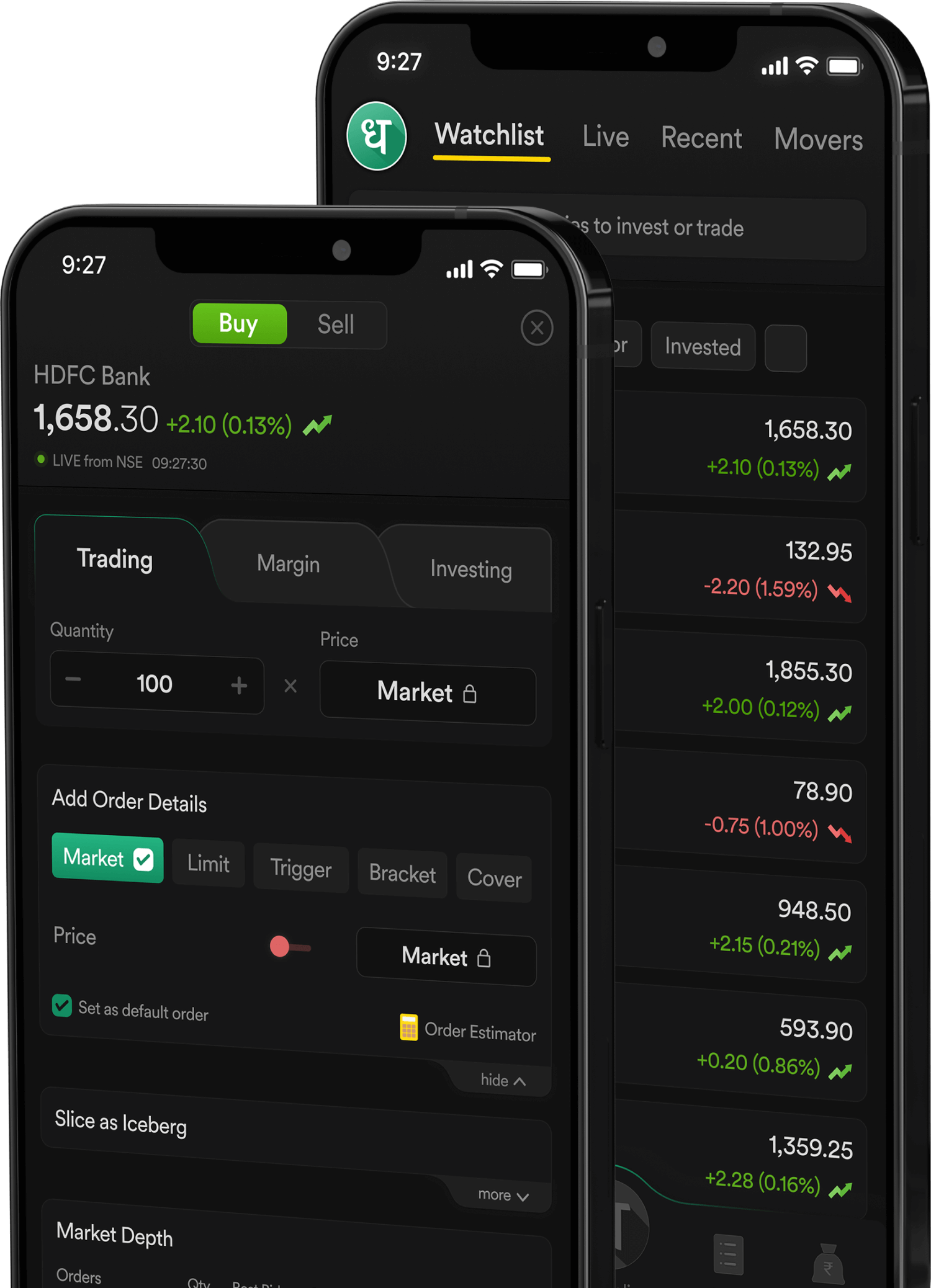

How to buy V Mart Retail shares online?

How to buy V Mart Retail shares on Dhan?

- Download the Dhan App to Open a Demat Account

- Navigate to the “Money Tab”

- Add money to your account

- Search for V Mart Retail share

- Tap on “Buy”